If you have started or have a business that is in the manufacturing or warehousing industry, you ought to get the relevant insurance covers to avoid any risks that may come your way. They may include property damage, losses, employee injuries, and liability lawsuits. Do extensive research to ensure that you tailor any of the latter risks and more. Start early since getting a reputable insurance company will take you time, mostly if you have never done it before. You certainly know that businesses are never a bed of roses; therefore, it is better to be safer than sorry. The points that follow show the essential insurances that are required in warehousing and manufacturing.

Product Liability Insurance.

The products you produce may land you in serious trouble if you neglect to cover them and later happen to be defective. If you discover that the design or worse yet, the product can harm or damage other people, for instance, you will be sued. What good is there if you overlook such details or even throw them under the bus? Therefore, scope a product liability insurance if you wish to evade lawsuits filed against your company due to a product’s malfunctions. Product liability may not be a legal requirement, but in manufacturing, it is significant because it will cost you loads of money if a claim is made against your business. The chances are that you will be held responsible for any defects and harm that the product may have caused to the client.

Commercial Combined Cover.

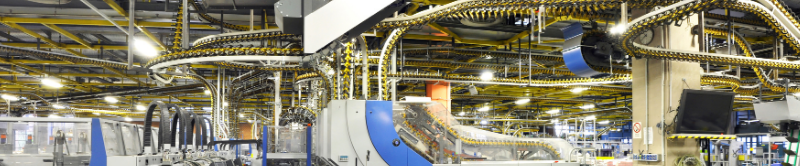

Most, if not all, factories handle numerous products after they have been manufactured. It is never easy to know what will fit all the commodities that you produce. That is where the insurance company comes in handy. They can advise you to pick this insurance cover since it caters to various wealth of trades across many industries. It is an umbrella that will save you a lot of time and money too. Can you imagine paying for all the products you produce separately? You will undoubtedly cough a fortune, unlike going for one package. As you research, you will come across this term; hence, do not brush it off. All you have to do is ensure that the package suits you and your business perfectly. It should include numerous policies and a liability cover, among others. Wholesalers whose focus is on their stock may go for this insurance cover since they will retain their money. Also, if you have manufacturing plants, you certainly understand how expensive they are, and ensuring that they are under the protection of this insurance cover is a great idea.

Inland Marine Insurance.

After the manufacturing process, the result is a finished product. It is vital to point out that the insurance coverage does not end in the factory but instead goes to the distribution centers. Inland marine insurance provides cover for shipped goods both locally and across the country, not to forget the property that houses them. Its primary concern is damaged goods in the sense that when there are accidents, and everything is damaged, this insurance only covers the value of the transit goods.

Factory And Warehouse Insurance.

The advantage of buying this insurance for your factory is that it is all-rounded, thus providing comprehensive coverage. It offers cover against monetary losses, which is caused by damaged goods, buildings, and machinery. Once you have been covered, you are guaranteed protection against theft and burglary, fire, natural calamities, and explosions alongside many others. Different types of policies lie in this insurance, and they include comprehensive cover, valued, specific, floating, and replacement and reinstatement policies.

On the contrary, under this insurance policy, there are extra covers that entail fidelity cover, public liability, plate glass cover, and fire loss of profit, among others. You will enjoy this insurance policy since it covers numerous risks; hence, you will not have to stress. Note that factory and warehouse insurance excludes intentional damages, pollution, and radioactive contamination and wear and tear. If you are in wholesaling, manufacturing, distributing, supplying, and packaging businesses, you can buy it.

Worker’s Compensation Insurance.

If you are starting a business, you must acknowledge that your laborers have the right to be compensated if things go wrong, and they are hurt while in the factory or warehouse. You have to take charge and ensure that things do not get out of hand. Therefore you should add it to the business’ insurance policy immediately you have hired an employee. There is no need to waste time because accidents occur abruptly. A worker’s compensation insurance covers medical treatment, disability, and death benefits. Whether an employee is doing the bare minimum, ascertain that they have been covered. You do not want them to be injured, and you are left responsible for something you could have prevented earlier.

Professional Liability Insurance.

Erase the mentality of getting a one-size-fits-all insurance policy when it comes to professional liability. There is nothing of the sort since all industries have their concerns and standards that ought to be met suppose one is to do business in any of them. This insurance policy is also known as errors and omissions insurance. It prevents negligence in business hence ensures that all tasks are performed.

Commercial Contents Insurance.

Warehouses or factory premises require equipment and machine for things to run as smoothly. However, if they break down or are stolen, you will have to look for money to purchase or get them fixed if they are not insured. When you buy a content cover, you will have peace of mind since your machine will be replaced, although not in a snap. In turn, your business operations will resume normally. Besides that, commercial contents insurance can also cover things like work in progress and stock. This insurance is undoubtedly a vital part of a manufacturer’s insurance policy.

Business Income Interruption Insurance.

Natural calamities such as tornados can bring your business down since it is something that you have no control over. You will lose a lot of income and be forced to lay off the staff members because everything will be at a stand-still. Some manufactured products may end up going bad due to the time that will be taken for things to run as they should. In other circumstances, some may be destroyed to the point that they will be of no use. Machines and equipment may be damaged to the point that they cannot be revived and, worse yet, even recognized. However, if you buy this insurance cover, you will avoid excessive financial loss since it caters to catastrophic events. You must check with your insurer and get advice about the form of insurance your business requires since each company has different needs. The purpose of a business income interruption cover is to ensure that companies are fuelled with income while the repairs and replacements are taking cause.

Warehouse Legal Liability Insurance.

You may have come across that term or the other antonyms that include warehousemen’s legal liability insurance and warehouse operator’s legal liability insurance or maybe not. It is a special type of insurance that covers damage due to the facility’s maintenance issues, inventory loss, and gross negligence on the employees’ part. Any of the mentioned issues may affect the inventory, and when they do, your warehouse provider is to be held accountable. The purpose of this insurance is to ensure that the warehouse provider pays every dime for the damages or losses caused without a bargain. That being said, if you are assessing warehouses, please ask for a copy of the legal liability insurance certificate from the warehouse provider.

You do not want to end up without an inventory and compensation to make any replacements whatsoever. Both the warehouse owner and the people on the ground should ensure that they take care of your goods. Note that policies vary from one warehouse to the other as much as each has claims that they cover. The latter include damage of property caused by a smoking employee in an area that is prohibited, careless handling of products which results in damage, the destruction caused by insufficient facility maintenance, and inventory damage. The warehouse provider should ensure that the employees do what they are hired for and well. Catastrophic events are, however, not covered in a warehouse legal liability insurance.

Vehicle Insurance.

If you have already invested in vehicles, you would be sorry if you failed to buy a vehicle insurance policy; this is nothing to think twice about. You may have seen or heard of many road accidents and would not dare work without insurance cover; furthermore, vehicles cannot operate without it. Therefore by the day, they are scheduled to work, you should ensure that they have been insured. That way, you will evade any liabilities when an accident occurs. Picking a comprehensive cover or insuring against a third-party injury at the very least should protect your vehicles in case of an accident. If you have numerous vehicles that employees use, buying a personal insurance cover will go a mile when an accident occurs.

Warehouse Owner And Operator Insurance.

Do not forget your workers and, worse yet, yourself while struggling to ensure that they are safe. Getting the right insurance should be a priority to a warehouse owner to avoid problems that may come along the way. As you get an insurance cover, consider the warehouse’s size since insurance companies are built to customize insurance covers to your liking. Insurable exposures of the public, commercial distribution warehouses, and logistic companies are offered special coverage for warehousing insurances. Many risks can occur in a warehouse while moving and transporting goods; hence, your workers ought to keep this in mind. Warehousing insurance includes management liability, stock in trade, glass breakage, cyber liability insurance, and property insurance.

Equipment Breakdown Coverage.

Machines can breakdown without an alarm, and if you have this coverage, you will be at peace since the damage is easily repairable or even replaceable if it is beyond repair. Working without significant machines will cause delays; however, an equipment breakdown coverage will even grant you a chance to rent one. That way, the business will not be interrupted if repair is taking a long time.

Buildings Insurance.

Manufacturing and warehousing may require you to purchase a piece of land and build your business. It is essential to have the building insurance cover. However, some people may choose to take a rental, and that is alright. What you will do is confirm with the landlord or landlady the person responsible for ensuring that the commercial building cover of the property is available. Although saving yourself from paying any repair damages that are not your responsibility is good, it is not legally required.

The above points show the vital insurances of warehousing and manufacturing. You must ensure that you seek a professional’s help if you are stuck since they are experienced and knowledgeable. So much may seem blurry to you, and keeping quiet about it will take you nowhere; hence, make inquiries. You must work with a reputable insurance company if you want to avoid getting disappointed in the end. Take time when looking for the ultimate one, and you will enjoy working with them. Choose an independent insurance agent because they will cater to your needs in the best way yet.

Please do not overlook the policies that have been put in place: read them to the latter so that you may know what you are getting yourself into. Remember that the size of your business premises does not matter; get it insured regardless! The possibilities of catastrophic events to take place are unknown, and you undoubtedly want to be ready when you are caught off-guard with the relevant insurance policy. Note that there are no specific insurance costs since they all depend on the client’s needs, which differ from one person to the other. Do not be afraid to explore all the options you have because that is how you will end up with a good deal.